Our Services

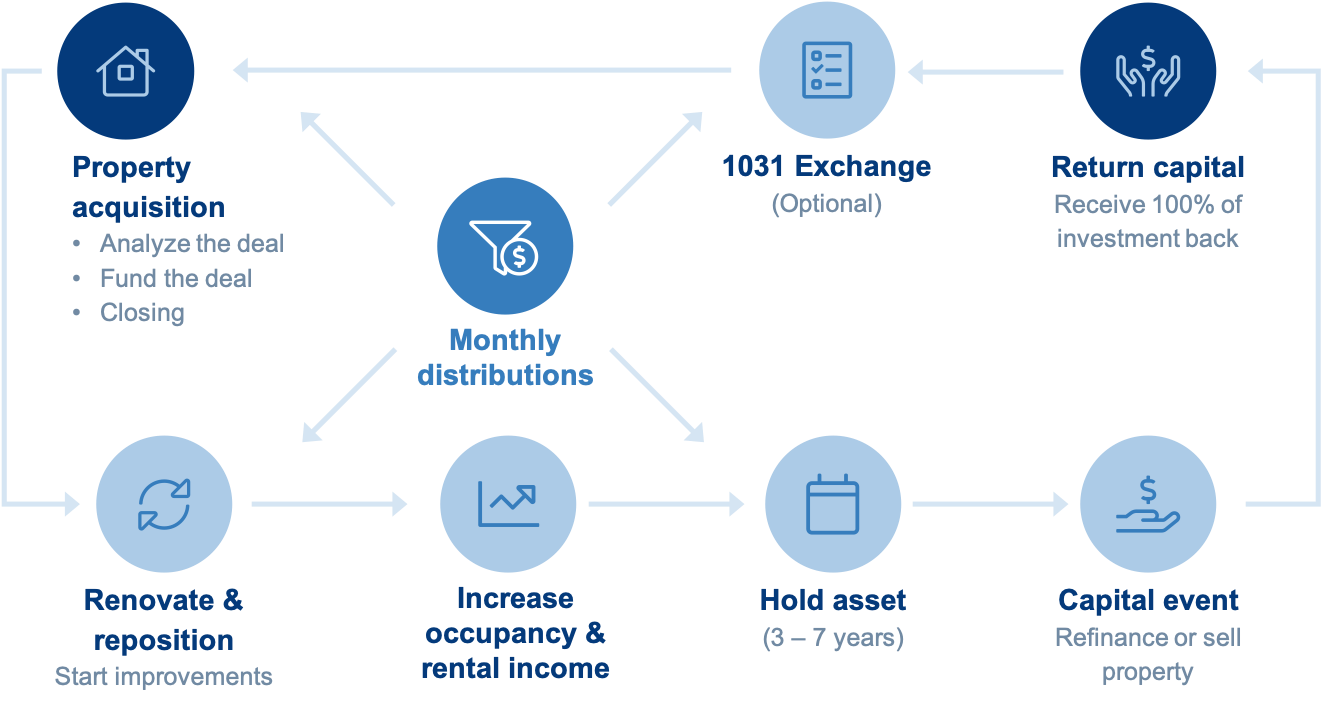

MM Equity Group offers direct access to meticulously selected real estate opportunities.

We emphasize equity growth, cash flow stability, and strategic renovations to enhance property value and attract quality tenants.Our model is designed to provide attractive returns, leveraging South Florida’s thriving market to build a resilient and diversified investment portfolio.

Leveraging our comprehensive expertise in asset management, investment analysis, and data acquisition, MM Equity Group is poised to guide you through the intricacies of real estate investment, uncovering a broad spectrum of opportunities tailored to your financial ambitions. Our commitment extends beyond mere guidance; we offer a partnership model where we join forces in a joint venture, sharing in the profits post-resale. This collaborative approach ensures that we are fully aligned with your investment objectives, striving for mutual success in every transaction.

70+ years of experience in management, brokerage, tenant relations, leasing, acquisitions, debt structure, renovations, city requirements, development, etc

Range from professional executive suite centers to large office buildings

Include strip malls, community retail centers, and large malls.

Encompass warehouses, distribution centers, and manufacturing facilities.

Rental Apartment buildings or communities.

Hotels, Motels, Resorts

Combine residential, retail or office space

Positioned in high-demand areas, these facilities provide consistent income through parking fees with minimal maintenance.

FAQs